At the beginning of last year, I introduced Nittobo (3110 JP) to readers for the first time in an article (Nittobo (3110 JP) -- The King of Electronic Fiber Glass), where I explained that electronic-grade fiber glass is categorized into three levels from low end to high end: E-glass, NE glass, and NER glass. Over the last one year, I have received many messages from readers asking for an update on the electronic fiber glass industry. Therefore, I will discuss today the latest development of the next generation electronic fiber glass.

First of all, we know that glass fiber is one of the raw materials used in manufacturing copper clad laminates (CCL). A complete CCL is formed by combining glass fiber cloth with resin and copper foil. Currently, the highest grade of CCL is M8, and the next-generation M9-grade CCL will enter mass production in the second half of 2026, with expected applications in: 1) PCB board for 1.6T switches; 2) orthogonal backplane for Nvidia’s Kyber/ NVL288 racks (please refer to my previous article: NVIDIA (NVDA US) 2025 GTC Review – Is Amphenol (APH US) Dead Beyond NVL72?); 3) PCB board for Google TPU V7 servers; and 4) PCB board for AWS Tranium 3 servers.

The raw material composition of next-generation M9-grade CCL includes polyphenylene oxide resin (PPO) + HVLP4 or HVLP5 copper foil + NEZ Glass or Q Glass. I’ve previously explained HVLP copper foil in details (please refer to: NVIDIA (NVDA US) 2025 GTC Preview -- An Update on its Latest CPO Switch and NVL288 Design). Today, I will focus on explaining the technology roadmap for the next-generation electronic fiber glass.

So far, all low signal loss CCLs have been adopting Nittobo’s glass fiber cloth approach—from first-generation NE Glass to second-generation NER Glass. However, starting with M9-grade CCLs Nittobo and its competitor Asahi Kasei have taken divergent paths with two completely different technology approaches: Nittobo continues with its traditional glass fiber approach, optimizing electrical performance by adjusting the ratios of silica and boron oxide in its products. Its next-generation product continues under the NE series and is named NEZ Glass. In contrast, Asahi Kasei completely abandons the glass fiber approach and uses quartz fabric with a silica content of up to 99.9%. Thus, its next-generation product is called Q Glass (“Q” stands for Quartz). The table below compares the compositions of different types of glass fiber and quartz fabric:

We can see that Nittobo’s glass fiber products contain about 45%-55% silica and 20%-30% boron oxide. Additionally, they include alumina, calcium oxide, magnesium oxide, and coupling agents to adjust the melting point during production (the exact proportions are top secret of the company, so only approximate ranges are provided here). Simply put, the higher ratio the silica and boron oxide content in the glass fiber, the lower the coefficient of thermal expansion (CTE), dielectric constant (Dk), and dissipation factor (Df). As such, from the first-generation to the third-generation of Nittobo’s NE series, the silica and boron oxide content have been steadily increasing: NE Glass contains about 45%-55% silica and 15%-20% boron oxide, while NEZ Glass has increased to 50%-55% silica and 25%-30% boron oxide.

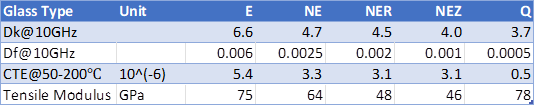

There are three main performance indicators for electronic-grade glass fiber: coefficient of thermal expansion (CTE), dielectric constant (Dk), and dissipation factor (Df). The lower these values, the better. I’ve already explained Dk and Df in my previous article (please refer to: NVIDIA (NVDA US) GB300, Vera Rubin & Beyond – An Update on Future PCB/CCL and Power Design Change): the dielectric constant (Dk) represents the degree of attenuation electromagnetic waves experience in a dielectric. A lower Dk means less base material loss and weaker attenuation of electromagnetic waves. The dissipation factor (Df) measures energy loss as a signal passes through the material. Simply put, Df indicates how much dB of signal is lost from one end of a board to the other. A lower Df means less energy loss and more efficient signal transmission. In terms of electrical performance loss in high-speed signal transmission, Df is relatively more important than Dk, because Df represents signal attenuation (i.e., energy loss), while Dk only affects signal speed. To illustrate in a simple example: in a 100-meter race, regardless of speed, an athlete can reach the finish line—that's determined by Dk. But if the athlete doesn’t have enough energy to finish the race, that’s determined by Df. Therefore, in practical CCL manufacturers focus more on low Df values to ensure signal transmission integrity. The table below compares the main performance indicators of different types of glass fiber and quartz fabric:

We can clearly see from the above that although Nittobo’s third-generation NEZ Glass performs better than the second-generation NER Glass, Asahi Kasei’s Q Glass, with 99.9% silica content, naturally possesses lower electrical loss and thermal expansion advantages, making it better suited for high-speed signal transmission. For example, at a 10GHz frequency: NEZ Glass has a CTE of 3.1 PPM/°C, a Dk of 4.0, and a Df of 0.001. In comparison, Asahi Kasei’s Q Glass performs better with a CTE of 0.5 PPM/°C, Dk of 3.7, and Df of 0.0005. In fact, 100% pure quartz fabric can achieve a Df of 0.0002, but due to post-processing and treatment effects during production, complete purity is almost impossible to achieve. Therefore, Q Glass reaches a Df value of 0.0005, still half that of NEZ Glass.

At this point, some readers may wonder: since Q Glass outperforms NEZ Glass in every aspect, why don’t CCL manufacturers just switch entirely to Q Glass? The reality isn’t that simple. Despite its superior performance, Q Glass has two drawbacks as well:

1) Compared with ordinary glass fiber materials, its pure silica has strong structural stability, requiring more complex processes and equipment for quartz material processing. Moreover, Q Glass is much harder than NEZ Glass, which increases the risk of residual fiber protrusions in PCB drilling holes, affecting subsequent copper plating process (the less smooth and flat the copper plating surface is, the more it affects the transmission of high-speed signals). This reduces production yield when using Q Glass and effectively increases manufacturing costs.

2) Q Glass is significantly more expensive than NEZ Glass. The chart below shows the average price levels of different grades of glass fiber and quartz fabric. Compared to NEZ Glass’s price of $25–30/meter, Q Glass costs about $50/meter—1.7 to 2 times as NEZ Glass (see chart below):

Despite its difficulty in processing and higher cost, my recent supply chain research indicates that M9-grade CCLs are still highly likely to adopt Q Glass as the mainstream material. Several factors contribute to this, but the most critical one is that: M9-grade CCLs require a Df value of 0.0007 or lower, which NEZ Glass cannot achieve (its Df is 0.001), while only Q Glass, with its Df value of 0.0005, meets this requirement.

Additionally, Although the ASP of Q Glass is 1.7-2 times that of NEZ Glass, after discussions between CCL/PCB manufacturers and AI server clients, end clients generally accept the price increase, because the value of performance improvements in high-speed transmission far outweigh the additional cost. Moreover, for high-end AI server applications, CCL cost represents relatively small portion of the overall BOM, so this extra expense has little impact on the end clients’ total budget.

Finally, CCL manufacturers have their own supply chain considerations as well: as mentioned in my previous article, only Nittobo (Japan) and AGY (USA) can supply the highest-grade glass fiber yarns. Although several Taiwanese and Chinese companies have claimed to be able to provide high-grade electronic glass fiber yarns, most can only supply first-generation NE Glass. According to my understanding, aside from Nittobo and AGY, only Taiwan Glass has a proven track record of mass-producing second-generation NER Glass. In contrast, the supply of quartz yarn for Q Glass is much broader. Purifying 99.9% silica is not a super difficult process (the real challenge is preventing breakage during weaving), so more and more Taiwanese and Chinese quartz material suppliers are entering the electronic-grade quartz fabric market. From a CCL manufacturer’s standpoint, adopting NEZ Glass means long-term dependence on Nittobo, which has a history of supply shortages form time to time. Using Q Glass allows them to find and support more local suppliers in longer term, enabling price negotiations and avoiding future shortages. Though Q Glass is harder to process, yield issues can be eventually solved with time and experience accumulation, whereas supply shortages are fatal to CCL makers.

Therefore, I dare to predict that in the technological race for next-generation electronic-grade glass fiber, Asahi Kasei’s Q Glass is very likely to become the mainstream solution over Nittobo’s NEZ Glass. In the following paragraphs, I will introduce a lesser-known company that stands to benefit from Q Glass adoption in the future.

Keep reading with a 7-day free trial

Subscribe to Global Technology Research to keep reading this post and get 7 days of free access to the full post archives.