After a period of relative silence, investor interest in 800G/1.6T optical modules and CPO switches has recently surged again. Therefore, I would like to take this opportunity to introduce to readers a relatively unknown high-speed optical module and CPO play from Japan — Maruwa (5344 JP).

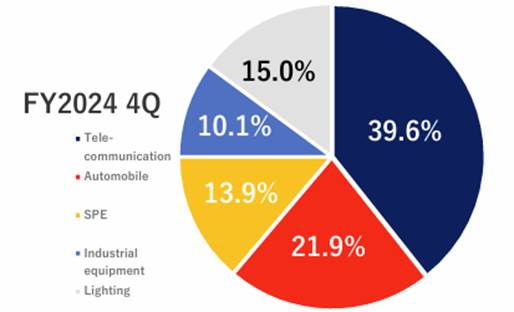

Let’s first take a look at the company’s background overview: Maruwa is a publicly listed Japanese manufacturer of ceramic substrates, mainly producing substrates made of various ceramic materials such as alumina (Al₂O₃), aluminum nitride (AlN), silicon nitride (Si₃N₄), and zirconia (ZrO₂). These ceramic substrates are used in various downstream industries depending on their properties (for example, AlN substrates are best at heat dissipation, while Si₃N₄ substrates have the highest hardness and strength). Below is a brief introduction of Maruwa’s product applications in different sectors based on the segment breakdown disclosed by the company (see chart below):

Industrial Equipment (~10% of total revenue):

Main applications include ceramic heat dissipation substrates for power semiconductors (such as inverters used in trains and robots), high-temperature co-fired ceramic (HTCC) noise filters used in medical equipment, and ceramic substrates for laser chips in industrial laser equipment, etc.

Semiconductor Production Equipment (~14% of total revenue):

Main applications include quartz components used in semiconductor manufacturing equipment. These quartz parts are consumables in the wafer manufacturing process, mainly used in etching equipment and oxidation/diffusion furnaces. About 60% of the sales come directly from semiconductor equipment manufacturers (e.g., Tokyo Electron, Hitachi Kokusai, etc.), and the remaining 40% from semiconductor device manufacturers (e.g., TSMC, Samsung, etc.). Maruwa’s main competitor in this field is Ferrotec (6890 JP).

Lighting (~15% of total revenue):

Mainly ceramic heat dissipation substrates used in LED lighting.

Automotive (~22% of total revenue):

Main applications include ceramic heat dissipation substrates for automotive LED headlights and power semiconductors (such as inverters used in electric vehicles), ceramic substrates for shark fin antennas, and high-temperature co-fired ceramic (HTCC) circuit boards for automotive ECU/PCU, etc.

Telecommunication (~40% of total revenue), main applications including:

· Resistor substrates: Maruwa is the global No.1 player, supplying all major resistor manufacturers (e.g., Yageo, Panasonic, KOA, SEMCO, etc.); the No.2 player, Hokuriku Ceramics, is a subsidiary of publicly-listed Nippon Carbide Industries (4064 JP); the No.3 player is China’s Three Circle Group (300408 CH).

· Multilayer ceramic capacitors (MLCCs): Maruwa specializes in MLCCs for telecom base stations, supplying all major base station manufacturers except Huawei (e.g., Samsung, Nokia, Ericsson, Fujitsu, NEC, etc.).

· Ceramic substrates for base station antennas

· HTCC circuit boards for CMOS image sensors

· Last but not least, ceramic heat dissipation substrates for laser chips used in high-speed optical modules: Maruwa is the global No.1 player, supplying all major optical module manufacturers (e.g., Finisar, Cloudlight, InnoLight, etc.); the No.2 player is another Japanese publicly-listed company, Tokuyama (4043 JP).

Although Maruwa (5344 JP), like most Japanese conglomerates, has a wide range of businesses and product lines, its growth story is very straightforward: its biggest growth driver over the next two years comes from its ceramic heat dissipation substrates used in laser chips. Maruwa has reclassified this business—ceramic heat dissipation substrates used in high-speed optical modules (defined as 800G and above)—as AI-related business. In the most recent fiscal year, management revealed AI-related revenue was ¥9 billion, with an operating profit margin of about 45%, implying that AI-related business accounts for about 12.5% of total revenue and 15% of total operating profit in FY3/25. According to the my own estimates, with the rapid growth in the volume of 800G/1.6T optical modules over the next two years, coupled with the new development of CPO switches from zero to one, Maruwa’s AI-related business will contribute about half of the company's total operating profit by FY3/27.

Furthermore, since the news broke last year that NVIDIA would soon launch CPO switches (Co-Packaged Optics (CPO) – The Next Big Thing for Nvidia (NVDA US)?), investors have generally maintained a relatively pessimistic view on the long-term prospects of optical module companies, on the theory that once major CSPs switch to CPO, standalone optical modules would no longer be needed in the future. However, while Maruwa shares the same growth story as optical module companies, it will not suffer from the negative impact of CPO replacing optical modules. This is because Maruwa's ceramic heat dissipation substrates are used in laser chips, and as long as optical communication is involved—whether through traditional optical modules or CPO switches—a light source is still required (in CPO, the light source is externalized), and thus laser chips and the ceramic heat dissipation substrates beneath them are still needed. In fact, since CPO switches in the future will require laser chips with much higher power (from 70mW → 100mW → 200mW → 300mW), this will lead to higher thermal dissipation requirements, thereby increasing the ASP of Maruwa's products. Therefore, the transition from optical modules to CPO not only does not negatively affect Maruwa but instead provides an even stronger growth engine in the following years.

In the following paragraphs of this article, I will perform a detailed analysis of Maruwa’s AI-related business.

Keep reading with a 7-day free trial

Subscribe to Global Technology Research to keep reading this post and get 7 days of free access to the full post archives.