Today, I will write about a fake AI play in Japan that was misunderstood by the market -- Enplas.

Enplas became well-known to the market following its FY1Q earnings report last August. For the first time, Enplas mentioned that its optical lens products are used in Coherent's 800G optical communication modules, claiming to hold a 100% market share with a gross margin as high as ~80%. This revelation ignited investor enthusiasm, and Enplas, originally an obscure Japanese test socket manufacturer, suddenly transformed into Japan's Coherent 800G proxy play and was subsequently dubbed a member of the Japan AI plays.

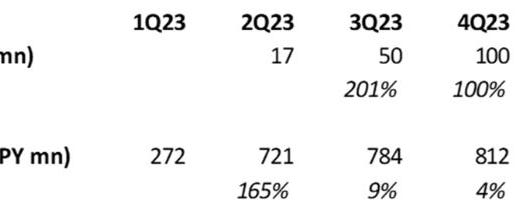

However, as Enplas continued to report earnings over two more quarters, the development of the situation began to look strange. We know that Coherent mentioned in the last quarter's earnings call that its 800G optical module revenue doubled QoQ, and in the previous quarter's call, it mentioned that 800G revenue doubled again QoQ. In contrast, Enplas's 800G optical lens revenue remained flat QoQ in the past two quarters (see table below):

If Enplas indeed held a 100% share in Coherent’s 800G optical communication modules as claimed, why would Enplas’s 800G revenue trend diverge from its customer's? The official explanation from the company was that Coherent encountered supply bottlenecks in some component parts during ramp-up, thus delaying volume production of the 800G modules. This explanation might suffice for Japanese domestic investors, but not for international investors.

The below table shows the quarterly production data of Coherent's 800G optical modules. it’s evident that the company has been ramping up 800G modules at over 100% QoQ rate, contradicting to Enplas’s claims of production bottleneck issue. In the following paragraphs I will explain in details on the real reason behind this:

Keep reading with a 7-day free trial

Subscribe to Global Technology Research to keep reading this post and get 7 days of free access to the full post archives.