Today, I would like to introduce two EMS (Electronic Manufacturing Services) companies listed in the U.S.: Celestica & Flex.

One of the most well-known stories about Celestica in the past one year is its role as the contract manufacturer for Google's TPU Server, transforming itself into an AI-themed stock. The company recently reported its 1Q24 performance, beating expectations and raising guidance, resulting in impressive performance.

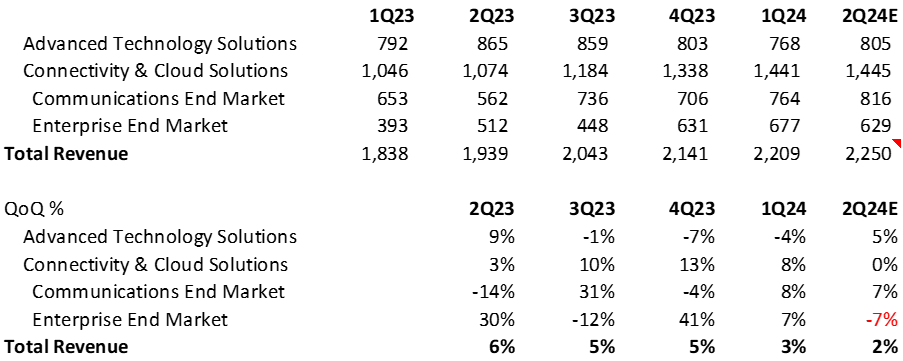

However, beneath the surface of Celestica's seemingly bright 1Q24 performance lies a hint of concern: according to the company's provided segment revenue breakdown and forward guidance, it's easy to deduce that the revenue from the Enterprise-end Market will decrease sequentially in 2Q24 (see table below), and this is precisely the segment to which Google TPU Server belongs:

Furthermore, based on the company's provided full-year 2024 guidance, we can further deduce that Celestica's Connectivity & Cloud Solutions (CCS) Segment revenue growth will slow down to only 1% sequentially in 2H24. The company's management commented that the Communications-end Market will continue to grow sequentially over the next few quarters, which implies that the revenue from the Enterprise-end Market (i.e., Google TPU Server) in the CCS Segment will decrease by 8% sequentially in 2H24 (see table below):

This has raised concerns among many investors: according to the supply chain research, Avago (the designer of Google TPU chips) saw a significant sequential increase in its TSMC CoWoS wafer in 1Q24 and 2Q24. However, why does Celestica, as the assembler of Google TPU servers, in contrast foresee a declining trend in its related revenue in 2Q24? It typically takes about a quarter from CoWoS wafer to complete TPU server assembly. Therefore, if we calculate based on the quarterly CoWoS wafer data from upstream, downstream TPU Server assemblers should see a sequential revenue growth trend at least until 3Q24.

The below table shows AVGO CoWoS wafer shipment by quarter (in k wafers):

Keep reading with a 7-day free trial

Subscribe to Global Technology Research to keep reading this post and get 7 days of free access to the full post archives.